Q1 2024 Nonprofit Talent Trends

Our latest assessment of recruitment activity for senior roles in the Irish nonprofit sector shows a continuing increase in the number of roles advertised. Our review of the main websites and jobs platforms shows that there were 287 roles advertised in the first quarter of 2024, up 42 (17%) on the same period last year. The number of organisations actively recruiting rose by 19% year-on-year, up 33, from 176 to 209.

Q1 2024 Nonprofit Talent Trends Summary

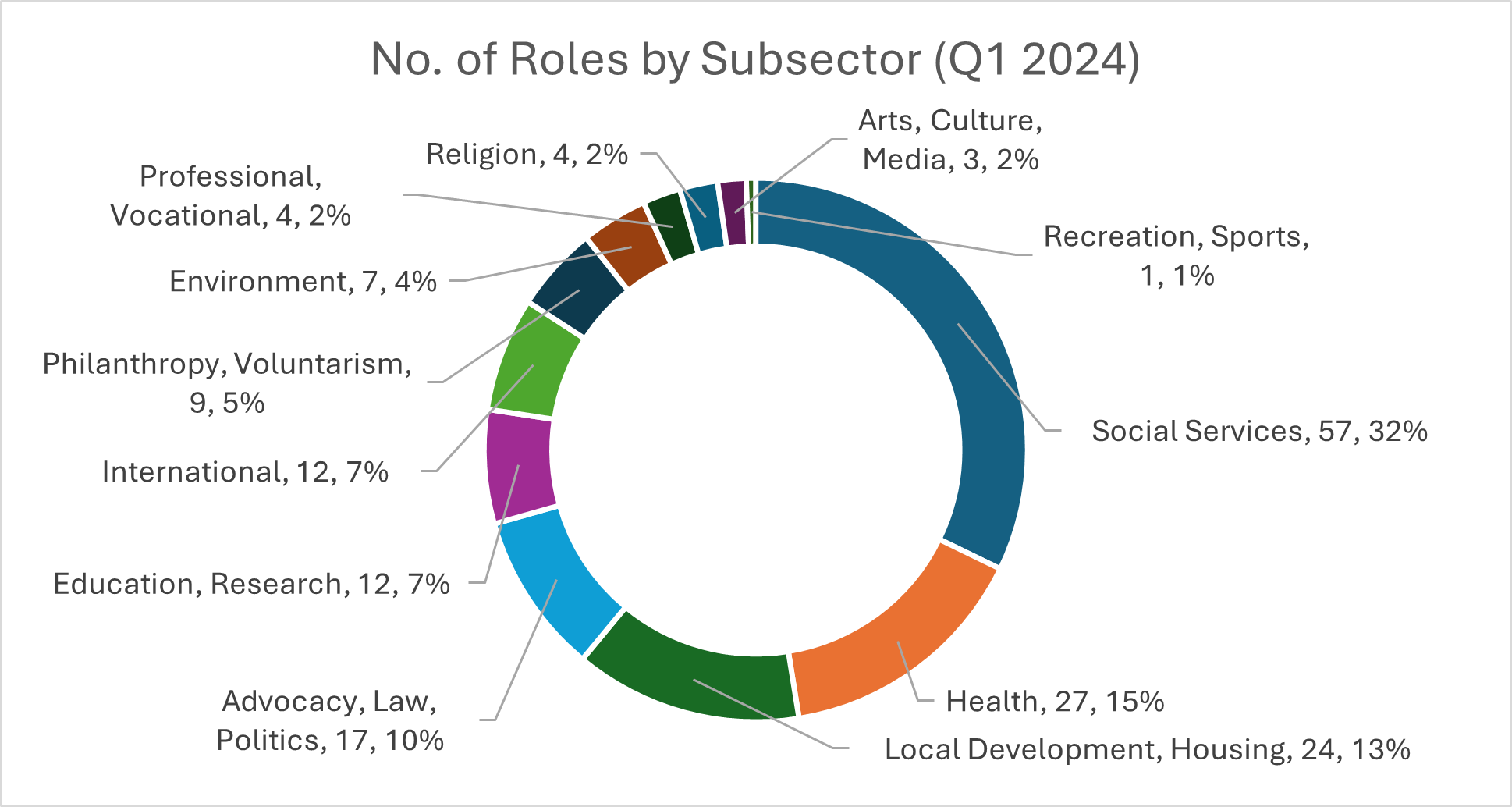

Activity by Subsector

The number of roles being advertised anonymously continues to increase, with 32 of the 209 (15.3%) of recruiting organisations unknown. This means that the analysis below is based on 177 known organisations.

The change in activity by organisation varied by subsector, with four areas showing a decline in activity (Arts, Culture & Media, Health, Professional & Vocational and Recreation & Sports). All other sectors were more active, plus the previously mentioned increase in anonymous postings, up a significant 146% year-on-year.

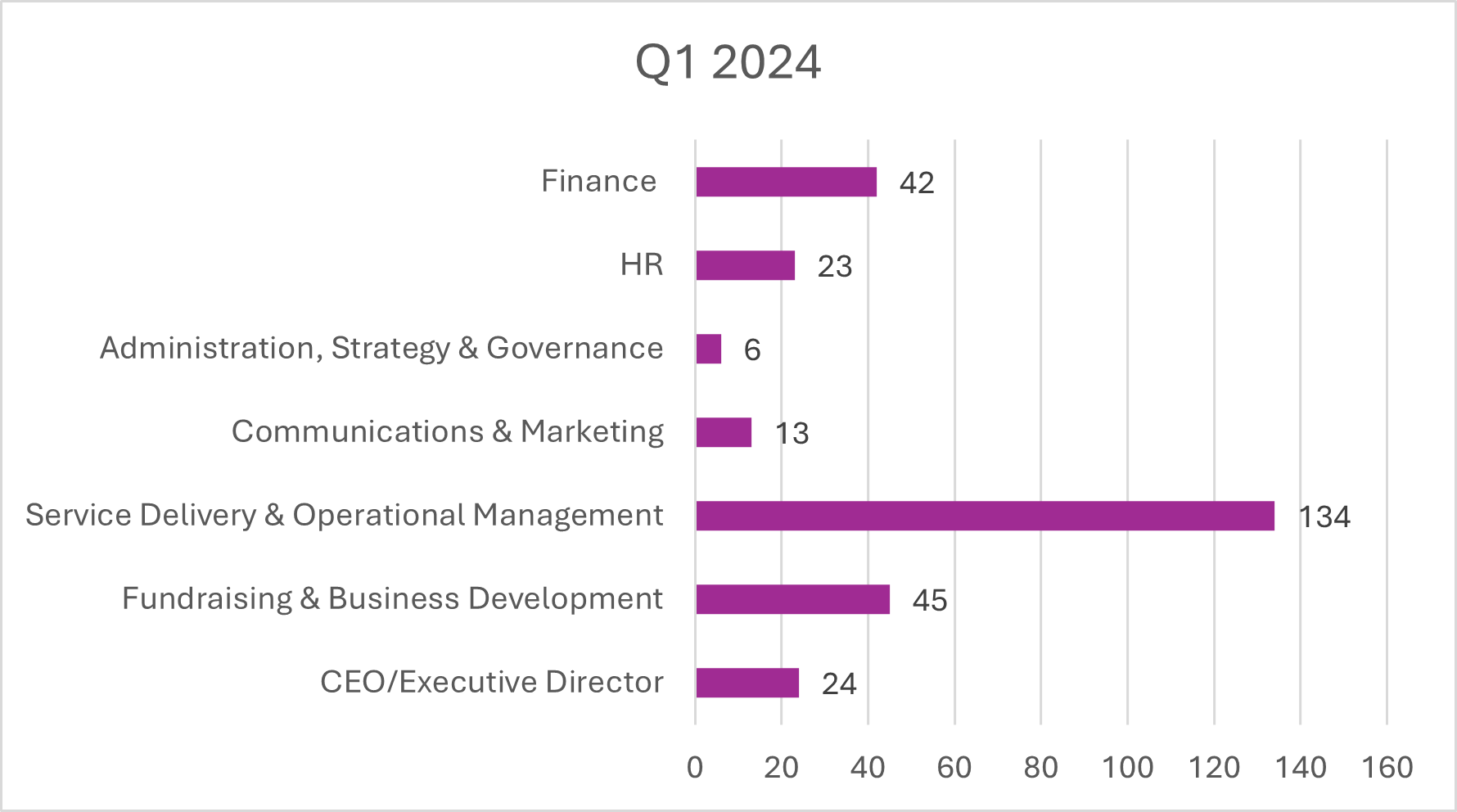

Activity by Role Type

Service Delivery & Operational Management roles were by far the most advertised in Q1 2024, with 134 of the total, way ahead of the second most popular, Fundraising & Business Development (45) and Finance (42).

That large number of Fundraising & Business Development roles is actually a drop of 9 versus Q1 2023 and is one of two role types that saw a reduction in activity, with Administration, Strategy & Governance roles dropping 40%, from 10 to 6.

All other role types saw an increase, some quite modest, such as CEO/Executive Director roles increasing from 23 to 24, while others showed quite significant increases. The number of Finance roles for example, increased by almost 45%, from 29 to 42, whilst HR roles jumped a massive 77% (from 13 to 23).

Activity by Income Type

The split in terms of organisation size remains consistent, where such information was available, either because the role was posted anonymously, or the organisation does not share their income. 42 organisations (26%) had annual income over €10M, while 41 (25%) had less that €1M in annual income; the remaining 49% were somewhere in between.

Observations

Activity remains high in the sector and continues to show a year-on-year increase for the first quarter, but that upward trend is not equally distributed throughout the sector, or indeed the types of senior roles we have seen advertised. The level of anonymous roles is now a significant part of the data we are capturing, with approximately 1 in 6 roles for the period. Why organisations are choosing this approach is uncertain. Potentially, they do not wish to share their plans (or salaries) with the wider public or are they “testing the waters” to see what candidates may show an interest, for example.

It is a curious development for a sector that relies so heavily on attracting individuals who can identify with the recruiting organisations’ mission, vision and values, so it remains to be seen whether this trend continues. For now, the market remains active, the level of active jobseekers remains tight, so it looks like there will be no change in this activity level for Q2 as things stand.

Get in touch

Our Talent Management Team record senior role activity in the nonprofit sector, producing quarterly findings. If you’d like to discuss these findings further, please contact our Director of Talent Management, Fergal O’Sullivan at fergal.osullivan@2into3.com. For more information on our Nonprofit Talent Trends, visit here.