Nonprofit Talent Trends: Q4 Insights & 2023 Overview

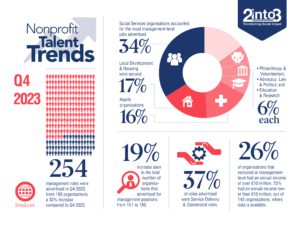

Our final quarterly analysis of Nonprofit Talent Trends for the year has shown a significant increase in activity, versus the same period last year. The number of roles we recorded as being advertised jumped from 193 to 254, an increase of 61, or 31.6%. It is interesting to note that the number of organisations who were seeking talent increased from 151 to 180. Therefore, it is clear multiple roles were available in a number of nonprofits.

Activity by Subsector

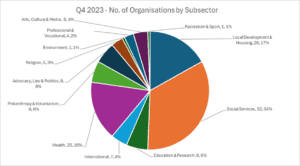

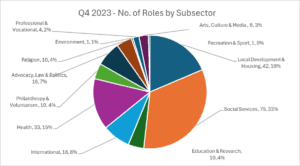

Where data was available, Social Services roles accounted for 34% of all roles advertised, followed by Local Development & Housing (17%) and Health (16.0%). The remaining 33% of roles came from all the other 9 subsectors.

Year-on-year, where data was available, activity within each subsector fluctuated:

- There were decreases in roles seen in 5 areas (Education & Research, Arts, Culture & Media, Professional & Vocational, Environment, Recreation & Sport)

- Increases in role numbers were observed in the other 7 (Social Services, Local Development & Housing, Health, International, Advocacy Law & Politics, Philanthropy & Voluntarism, Religion).

Some of these were quite large in percentage terms (e.g., 900% for Religion) but these were often from low bases.

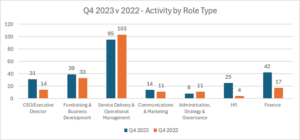

Activity by Role Type

The increase in roles advertised was not quite universal across all role types, with two areas (Service Delivery & Operations Management and Administration, Strategy & Governance) seeing a decrease. All other areas saw an upward trend, some quite substantially, such as CEO/Executive Director roles up by 121%, and HR positions by a massive 525%, albeit from a low base.

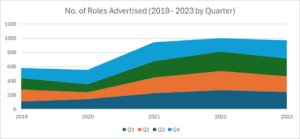

Annual Breakdown: 2023 Activity Vs. Prior Years

Looking at the whole of 2023, there was small drop in the number of roles advertised versus 2022 – down 3%, from 1,004 to 971. However, this still shows a relatively high level of activity versus the dark days of lockdown in 2020 and a sustained high volume for the years since the pandemic was at its height.

Subsector Breakdown

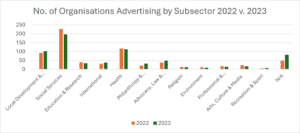

Where data was available, there were some fluctuations for the full year 2022 versus 2023:

By Organisation, there were decreases in activity for 7 subsectors, most notably Arts, Culture and Media (-33.3%) and Environment (-25%), with big increases observed in Philanthropy & Voluntarism (+45.5%) and International (+22.6%). The biggest increase was for roles where the subsector was unknown, highlighting the significant shift towards anonymous job advertisements over past year.

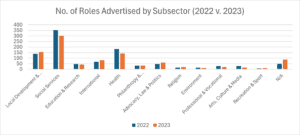

When looking at the number of actual roles, rather than organisations, there are some additional variations worth noting:

Decreases were seen in 6 subsectors, with increases in another 5; one sector (Philanthropy & Voluntarism was flat).

Advocacy, Law & Politics (+30.4%) saw the biggest increase, followed closely by Religion (+26.7%) while the biggest drops were observed in Arts, Culture & Media (-39.3%), Professional & Vocational (-32.1%) and Environment (-28.6%).

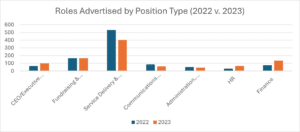

Activity by Role Type

For the full year, 2023 saw some significant changes in the types of roles being advertised in the sector.

Only Fundraising & Business Development roles remained virtually unchanged in terms of activity levels (+1.2%), with Administration, Strategy and Governance showing a drop of 11.8%. All other main role types saw significant shifts in numbers. HR roles rose by 127%, Finance by 78.7% and CEO/Executive Director roles by 50%. By contrast, significant drops were seen in the number of roles for Communications & Marketing (-30.6%), and Service Delivery & Operational Management (-24.8%).

Multi-Year Assessment

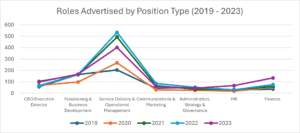

As an interesting snapshot, the final chart below shows the number of roles advertised, by type from 2019 to 2023. A consistency is seen across the five years, in terms of share of the total sector activity, with the greatest variations apparent in the level of Service Delivery & Operational Management roles and, to a lesser extent, Finance positions.

Summary

The one very obvious observation here is that activity has jumped significantly when you compare the last three months of 2022 to 2023, with almost a third more roles being advertised during the comparable period. This points to a very active sector with a strong demand for talent, something we in 2into3 are seeing for quite a while now, as the market remains tight and active jobseekers remain thin on the ground.

That said, activity for the year as a whole remained fairly flat, so the movement would appear to be very much towards the back end of the year. In terms of types or role, there seems to be a lot of fluctuation and no real pattern to discern and for the subsector activity, the biggest take away would appear to be the continuing rise in the number of organisations choosing to advertise their positions anonymously.

Away from the data, our own qualitative take from the trenches here in 2into3 is that the market remains challenging, with the number of active jobseekers remaining stubbornly low.

This is probably due to a number of factors:

- People who made career moves post-COVID not currently seeking another move.

- Those who achieved a good work-life balance by securing favourable hybrid working arrangements reluctant to give these up.

- Continuing economic uncertainty causing people to pause before moving to a new role.

Get in Touch

If you are currently seeking senior talent for your organisation, and require assistance, please contact our Director of Talent Management, fergal.osullivan@2into3.com. For previous examples of our work, click here, or for more information, visit our webpage.