Q3 2024 Nonprofit Talent Trends

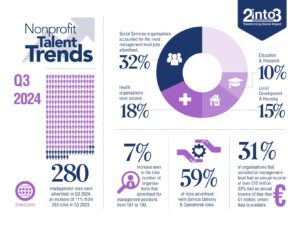

Our latest analysis of recruitment activity in the Irish nonprofit sector continues to evidence an increase in the number of senior management opportunities being advertised. Through assessment of a range of websites and job platforms, 2into3 has identified an 11% increase in senior-level management roles from Q3 2023 to Q3 2024, with the number of job postings catalogued rising from 253 to 280.

Similarly, the number of organisations advertising roles has grown by 7%, from the previous year’s 181 to this quarter’s 193. This suggests a positive hiring trend, with more roles being offered and more organisations participating in the job market.

Activity by Subsector

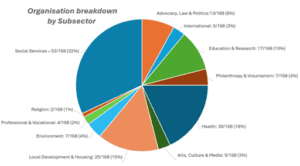

In Q3 2024, alike previous quarters, the trend of organisations advertising roles anonymously remains present. As 25 of the 193 organisations who advertised were anonymous, the below breakdown of roles by subsector is based on 168 known organisations.

Roles by Subsector

Social Services stand out as the largest subsector, making up 32% of the breakdown by organisation; indicating that this subsector remains the most dominant in hiring.

Whilst Local Development & Housing still holds a significant portion of the market, there has been a decrease of 36% from the 53 roles tracked in Q3 2023. This decrease in roles versus last year has been evident throughout 2024, with 40 roles being tracked in Q1, and 27 in Q2. This may be an indication that organisations in the Local Development and Housing sector, who have experienced rapid growth in the last number of years, have sufficiently built out and retained their teams thus reducing the need for recruitment drives.

Health continues to show strong growth, with a 37% increase in job postings compared to the previous year’s figures, highlighting an expanding need for talent in this subsector.

There is also an evident upward trend in the subsectors of Environment, Arts, Culture & Media and Professional & Vocational. The Arts, Culture & Media subsector shows the highest percentage increase in roles (from 1 to 6 roles, a 500% increase since Q3 2023), signalling an unexpected surge in demand.

Our analysis also shows that the Environment subsector has experienced significant growth, with an increase of 233% in roles since Q3 2023 (from 3 to 10 roles) which could indicate a rising investment in tackling issues such as sustainability. This growth is further evidenced by the fact 11 roles were tracked in Q2 2024 versus only 4 tracked in Q2 2023.

Activity by Role type

The above graph outlines the most in-demand skills appear to be Service Delivery & Operational Management, with a significant jump from 40% of roles recorded in Q3 2023 to 59% of roles recorded in Q3 2024.

Data extracted from LinkedIn Talent Insights indicate that the median tenure for professionals in Fundraising & Business Development roles in the Irish non-profit sector is approximately 1.3 years. Our data demonstrates that demand for skillsets relevant to fundraising and business development has increased since Q3 2023 which may indicate that high attrition rates have resulted in steady demand for individuals with this skillset.

It is apparent from examining the graph and the data that demand for CEO/

Executive Director’s has remained static since Q3 2023, while there has been a decrease in demand for Communications & Marketing roles (down from 9% to 4%) and Finance roles (down from 18% to 11%). As communications and finance are both essential role functions, it is plausible to infer from this data that organisations have focussed on improving staff retention resulting in reduced demand for these skillsets in this quarter, as a result.

Activity by Income Type

Excluding those where such information was not available, either because the role was posted anonymously or the organisation does not disclose their income; noteworthy findings were made regarding the income of 144 known organisations. 44 (31%) organisations have an annual income of over €10 million. 53 (37%) organisations have an annual income of between €1 million to 10 million. 47 (33%) organisations have an annual income of less than €1 million.

Observations

The non-profit market has remained highly active in Q3 2024, with growth in numbers of both job postings and organisations versus the same quarter last year, but also Q2 2024. 284 roles were tracked last quarter (Q2 2024), which closely aligns with the 280 roles recorded this quarter.

Comparing the figures of this quarter to Q2 and even Q1 of this year, where we tracked 287 roles, it is clear the number of roles advertised have stayed consistent throughout 2024 so far and that recruitment activity did not slow down significantly over the summer period, despite seasonal expectations.

Get in Touch

Our Talent team record senior role activity in the nonprofit sector, producing quarterly findings. If you’d like to discuss these findings further, please contact our Head of Talent Services, Shannon Barrett at shannon.barrett@2into3.com. For more information on our Nonprofit Talent Trends, visit here.