Q4 Nonprofit Talent Trends & Annual Overview

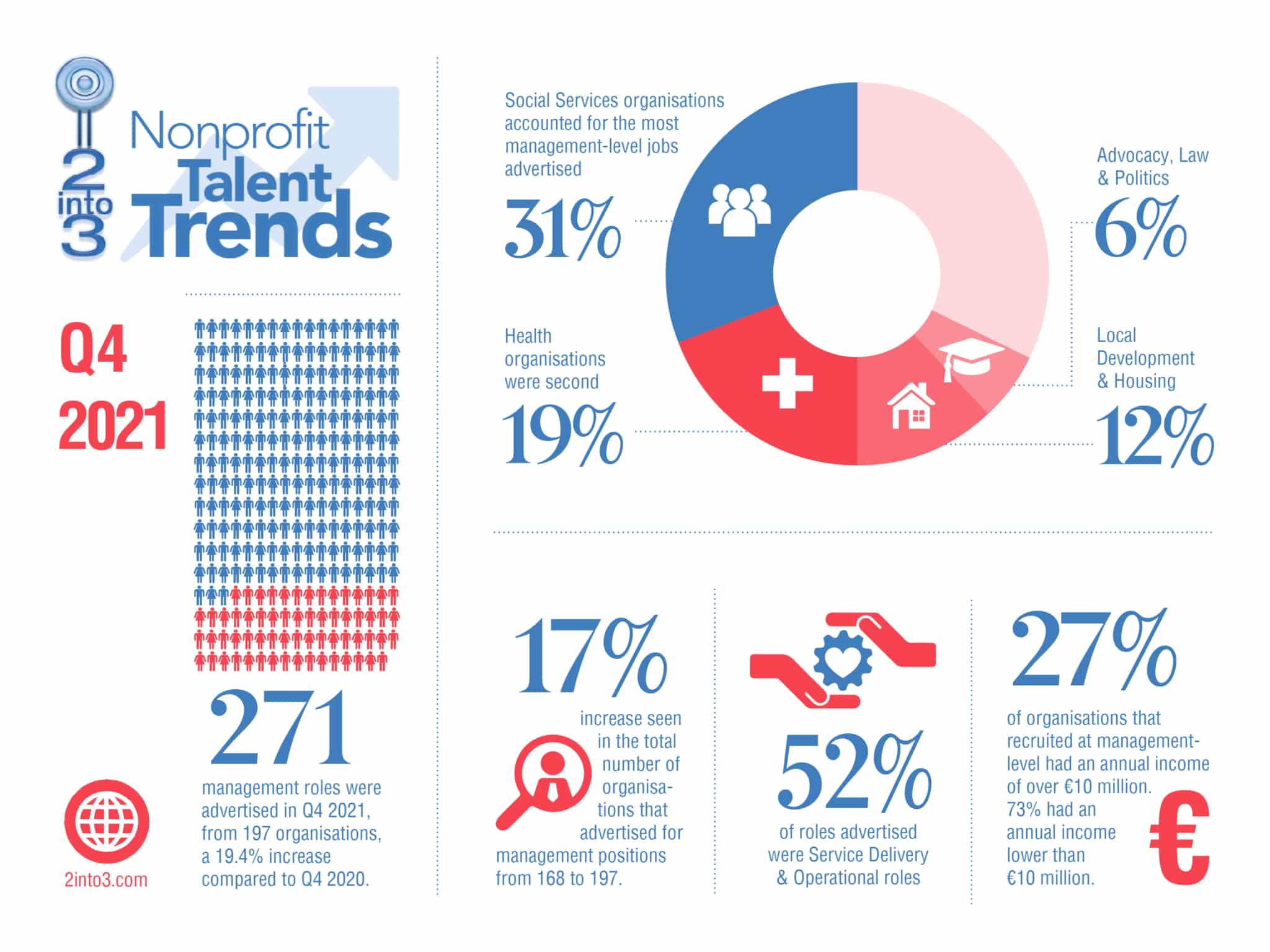

In our latest snapshot of the nonprofit recruitment market for senior roles, we saw a continued rise in both the number of roles being advertised (271, up from 227 in 2020) and in the number of organisations actively recruiting at this level (197, up from 168 the year before).

This rise of 19% and 17% respectively is not as large a jump as we would have seen in earlier quarters, probably showing that the pandemic rebound has been working its way through the market throughout 2021. While COVID has not gone away, organisations have realised they cannot wait forever to fill their talent gaps and have moved accordingly.

The numbers are way up on Q4 2019, the last full quarter before COVID became a word we utter several times a day; 144 roles from 115 organisations were advertised between October and December 2019.

Q4 Nonprofit Talent Trends Breakdown by Role

Two role types saw a fall in activity year-on-year (HR and Finance) albeit from a small base, while all other functions tracked showed increased activity. CEO level roles jumped by 70%, Fundraising & Business Development by 52% and Admin, Strategy & Governance doubled, but again this was from a small base.

Breakdown by Subsector

Breaking activity down by nonprofit subsector, the changes were mixed. Three subsectors saw a drop in senior recruitment activity we recorded: Local Development & Housing (-9%), Education & Research (-63%), Religion (-50%), Recreation & Sport (-33%).

By contrast, all other sectors saw a rise, with three in particular showing big increases in role numbers: International (240%), Professional & Vocational (433%), Environment (100%)

Where income details were available for those organisations that were active in the recruitment market, there was an almost even split between those organisations with income below €1M (47%) and those above the number (53%).

2021 Senior Recruitment Overview

Looking at the year as a whole, it is still difficult to make any comparison between 2020 and 2021 without the pandemic being attached as a health warning to the data.

The number of roles advertised rose from 558 to 948 according to our tracking. While this is an increase of just under 70%, it must be noted that the 2020 figures include a time when activity went off a cliff. That said, activity is still up by an almost similar number versus 2019, likely a result of recruitment campaigns being delayed.

Unsurprisingly, such uplifts were not confined to any particular role types, with all specialisms seeing a rise, although some were more active that others in that respect (Communications & Marketing (up 120%), HR (up 72%) and Service Delivery & Operations (up 85%)

Interestingly enough, despite this strong sector-wide bounce back, there were actually two subsectors that saw a decline in recruitment activity for the full year. Both Education & Research (-25%) and Recreation & Sport (-30%) saw a decline in roles advertised. All other subsectors saw increases in roles advertised.

What do these figures show?

Leaving aside the residual impact of the pandemic, what the figures here show us is that there is a renewed level of activity in nonprofit recruitment at the senior level, one that seems be sustained throughout year, and one that certain lappers to show no signs of abating in the first weeks of 2022.

What the figures do not show is the other side of this equation, namely the availability of talent to meet this demand. Active jobseekers are still a somewhat rare breed, with COVID uncertainty still not fully overcome, although signs of increased activity have been seen since Christmas.

It remains a challenging proposition for organisations to source (and then retain) the talent they need to provide their services, and 2into3 remain extremely active in the market on behalf of a wide range of organisations. Our hope is that while the market remains this active, the increase we have witnessed in jobseeker activity will continue to a point where supply and demand converge in 2022, giving all parties what they need, and the sector the supports it deserves.

For more information on our recruitment services, visit our website or contact Fergal O’Sullivan.