2into3 CEO Featured in The Journal on NGO Funding and Transparency

2into3 continues to grow its team with the appointment of sector stalwart Ivan Cooper, adding Policy and Advocacy to its Advisory Services.

2into3 continues to grow its team with the appointment of sector stalwart Ivan Cooper, adding Policy and Advocacy to its Advisory Services.

Mary O’Connor, CEO of the Federation of Irish Sport, emphasised the significance of this funding: “The Government has the power to make a meaningful impact on the sports sector in Ireland by recognising Sport’s social, health, and economic value and to prioritise core funding for long term impact. Return on investment is clear: for every €100 invested in sport the return is €209. While investment by Government in Sport and Physical Activity has increased significantly over the lifetime of the National Sports Policy, it is time for sport funding in Ireland to be in line with our European counterparts and match the EU average. With the current National Sports Policy in its final two years, we want Government to recognise Sport as a public good within national policy going forwards. Backing sport means backing communities all over the country.”

The Federation of Irish Sport was established in April 2002 by Ireland’s national sporting organisations to provide leadership, coordination, and advocacy on key issues, representing their interests to the government and relevant agencies. Now in its 21st year, the Federation represents over 110 National Governing Bodies (NGBs) and Local Sports Partnerships (LSPs), representing more than 13,000 sports clubs across Ireland.

The Federation’s mission is to empower its members to maximise the impact of sport, recreation, and physical activity for the benefit of society. Sport is not only essential for Ireland’s health and wellbeing but also contributes significantly to the economy, education, tourism, and the nation’s global reputation.

For media inquiries, please contact: Clare Louise O’Donoghue, Head of Commercial & Marketing, Federation of Irish Sport clarelouise.odonoghue@irishsport.ie, mobile: 0860437887, website: www.irishsport.ie.

As Ireland’s nonprofit sector continues to adapt to new challenges and growing societal needs, values-based leadership is fundamental to fostering organisational resilience, effectiveness and long-term sustainability.

Effective governance is not just a box-ticking exercise. It is the foundation for trust and, critically, for funding, which ultimately supports long-term success.

As Ireland’s nonprofit sector continues to adapt to new challenges and growing societal needs, values-based leadership is fundamental to fostering organisational resilience, effectiveness and long-term sustainability.

With the Government set to develop a successor to its current strategy for the sector – Sustainable, Inclusive and Empowered Communities – it’s timely to identify a few core objectives for inclusion.

Our latest quarterly analysis of senior-level recruitment in the Irish nonprofit sector presents a more tempered picture of activity when compared to recent upward trends. Following consistent growth across 2024 and into early 2025, our tracking of advertised non-profit roles across various job platforms reveals a year-on-year decline in management-level opportunities, decreasing from 284 roles in Q2 2024 to 250 in Q2 2025.

The number of organisations advertising has also softened slightly, with 186 organisations recruiting in Q2 2025, compared to 197 in the same period last year – a 6% decrease. This indicates a cooling period in senior recruitment activity, potentially reflecting funding pressures or restructuring following earlier expansion phases.

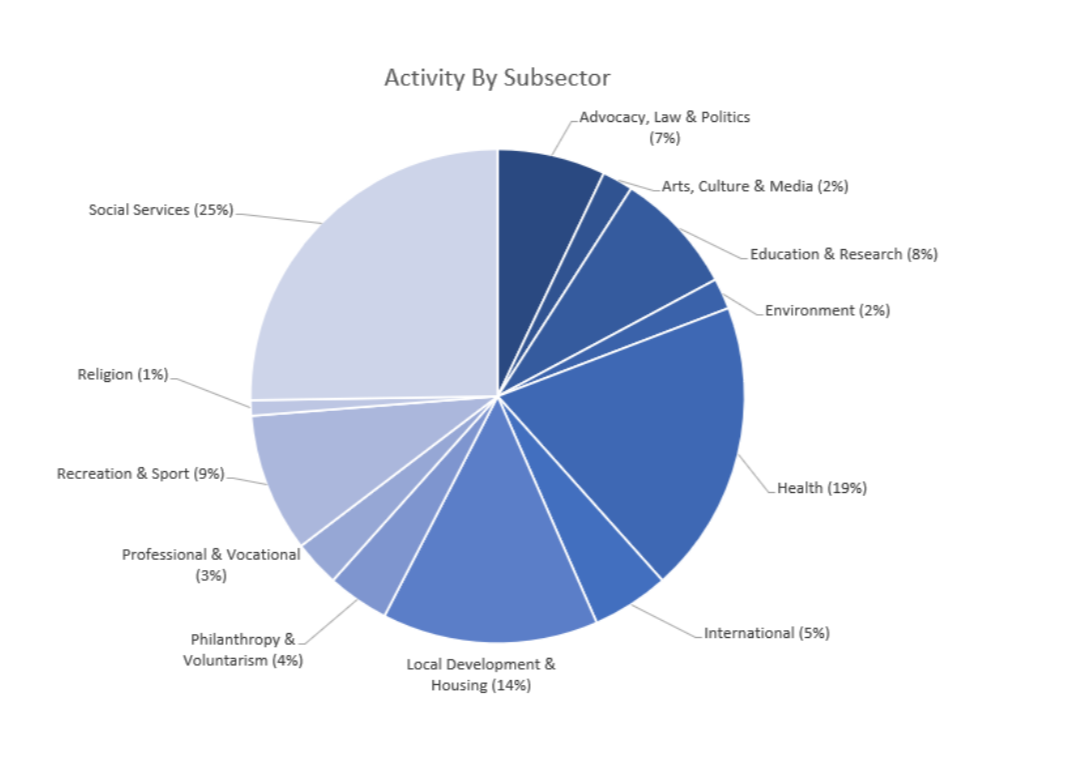

As in previous quarters, a number of organisations advertised their roles anonymously. Of the 186 organisations tracked, 25 were not identifiable, resulting in the below breakdown of 161 known organisations by subsector.

Roles by Subsector:

Social Services remains the most prominent subsector, representing 25% of known advertising organisations in Q2. Although this is a decrease from 33% in Q1, it continues to reflect strong demand for leadership in service delivery, while also suggesting a gradual diversification of hiring activity across other subsectors.

Health (19%) and Local Development & Housing (14%) continue to be significant recruitment areas. While the latter experienced a decline in roles in earlier quarters, its steady organisational presence points to sustained structural demand, particularly in response to national housing and community needs.

Building on our classification improvements in Q1, the growth of Recreation & Sport in this quarter’s data, now accounting for 9% of organisations, confirms the sector’s momentum and demand for sports leadership talent.

Conversely, the International subsector continues to decline, with just 11 roles recorded, a 42% drop from Q2 2024. This aligns with ongoing reductions in international development funding, including cuts from USAID, with longer-term impact reflected in reduced hiring, programme consolidation, and organisational restructuring.

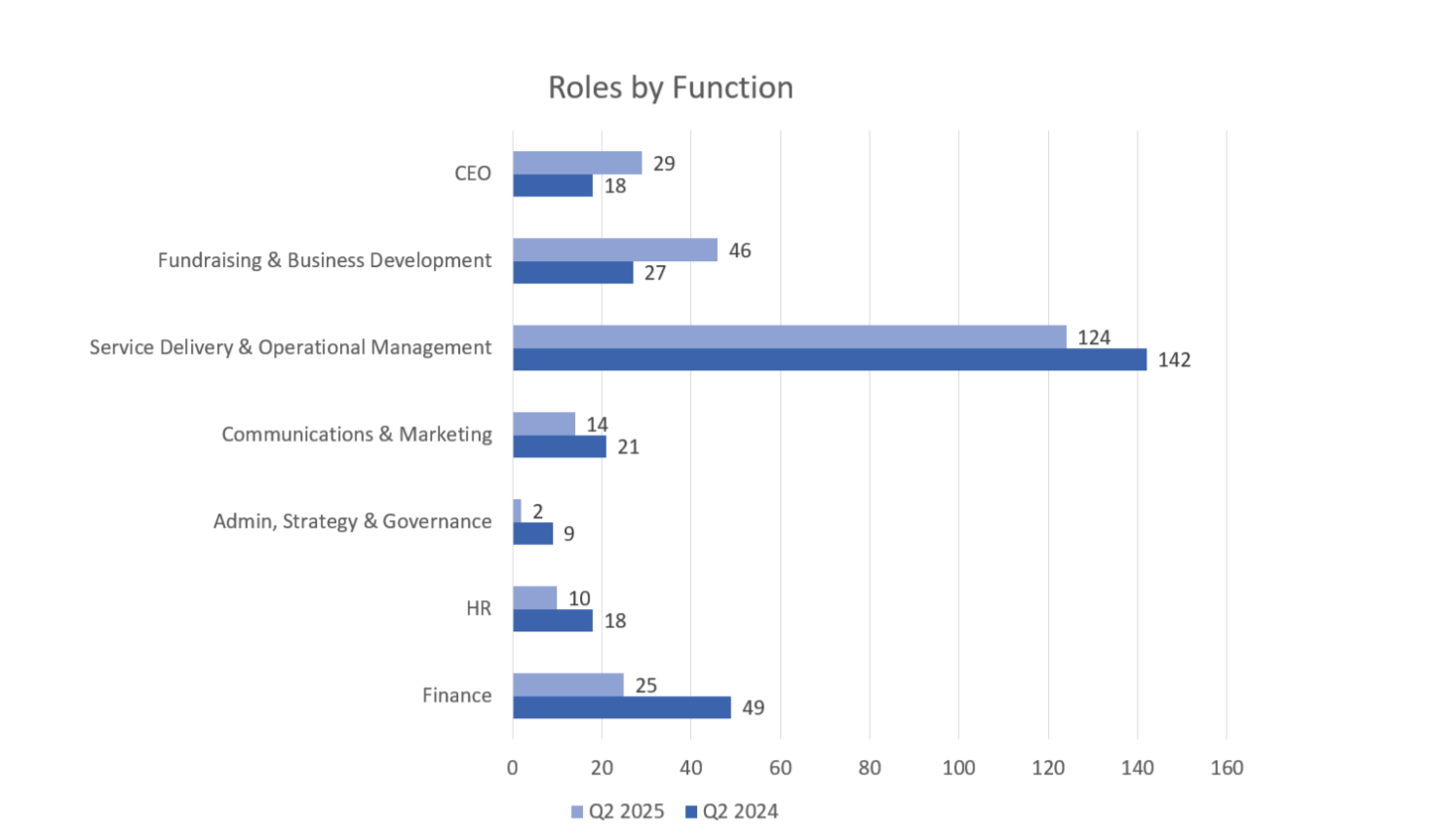

Service Delivery & Operational Management remains the most in-demand function, accounting for 41% of all roles advertised in Q2 2025. While this represents a modest decline from 47% in Q2 2024, it reinforces the continued prioritisation of programme delivery and frontline service leadership across the sector.

A particularly noteworthy shift is the increase in Fundraising & Business Development roles, rising from 10% to 18% of advertised roles, year-on-year. This trend indicates that organisations are placing a renewed focus on income generation, likely in response to funding uncertainty and the need to diversify revenue streams. This rise may also reflect higher turnover within fundraising functions, with fundraisers are navigating an increasingly challenging fundraising landscape in a space where median tenures already tend to be shorter.

The proportion of CEO roles has doubled, moving from 6% in Q2 2024 to 12% this year, suggesting greater movement at the executive level than in previous quarters. This also reflects a need for succession planning and strategic renewal within organisations who rely heavily on long-standing CEOs. This contrasts with trends seen in late 2024, where CEO recruitment was subdued.

Data regarding income was available for 139 of the 186 organisations, as those who advertised anonymously or did not disclose their income (47 organisations) were excluded.

Of the remaining 139:

This distribution aligns with patterns observed in previous quarters, highlighting a broad mix of organisation sizes engaging in senior recruitment. While the majority fall within the €1 million to €10 million income range, the data shows that larger organisations continue to dominate leadership hiring, suggesting they may have greater capacity to invest in senior talent acquisition.

Q2 2025 reflects a slight slowdown in nonprofit recruitment activity, with fewer roles and organisations participating compared to the same period last year. However, shifts in functional demand, particularly in leadership and fundraising, point to evolving sector priorities. Growth in areas such as health and sport, alongside reduced activity in international and finance roles, highlights a rebalancing of focus across subsectors.

Overall, while activity has softened, demand for senior talent remains strong and multifaceted, with organisations responding to a changing funding environment, evolving societal needs, and strategic growth ambitions.

Our Talent Management Team monitors senior hiring across the nonprofit sector and publishes quarterly insights. To explore previous Nonprofit Talent Trends Reports, visit our Talent Insights page. For more information, contact Shannon Barrett, Head of Talent Services, at Shannon.barrett@2into3.com.

Effective governance is not just a box-ticking exercise. It is the foundation for trust and, critically, for funding, which ultimately supports long-term success.

As Ireland’s nonprofit sector continues to adapt to new challenges and growing societal needs, values-based leadership is fundamental to fostering organisational resilience, effectiveness and long-term sustainability.

2into3 continues to grow its team with the appointment of sector stalwart Ivan Cooper, adding Policy and Advocacy to its Advisory Services.