Nonprofit Talent Trends Q2: Senior Recruitment Trends & Sector Insights 2025

Our latest quarterly analysis of senior-level recruitment in the Irish nonprofit sector presents a more tempered picture of activity when compared to recent upward trends. Following consistent growth across 2024 and into early 2025, our tracking of advertised non-profit roles across various job platforms reveals a year-on-year decline in management-level opportunities, decreasing from 284 roles in Q2 2024 to 250 in Q2 2025.

The number of organisations advertising has also softened slightly, with 186 organisations recruiting in Q2 2025, compared to 197 in the same period last year – a 6% decrease. This indicates a cooling period in senior recruitment activity, potentially reflecting funding pressures or restructuring following earlier expansion phases.

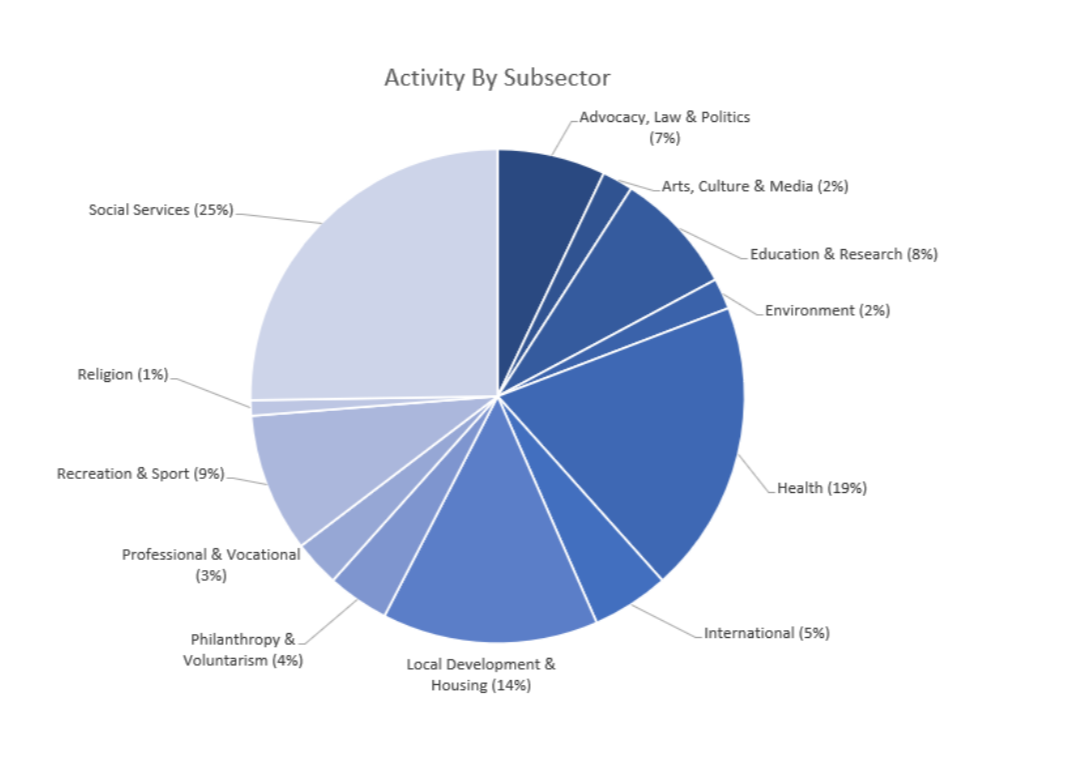

Activity by Subsector

As in previous quarters, a number of organisations advertised their roles anonymously. Of the 186 organisations tracked, 25 were not identifiable, resulting in the below breakdown of 161 known organisations by subsector.

Roles by Subsector:

Social Services remains the most prominent subsector, representing 25% of known advertising organisations in Q2. Although this is a decrease from 33% in Q1, it continues to reflect strong demand for leadership in service delivery, while also suggesting a gradual diversification of hiring activity across other subsectors.

Health (19%) and Local Development & Housing (14%) continue to be significant recruitment areas. While the latter experienced a decline in roles in earlier quarters, its steady organisational presence points to sustained structural demand, particularly in response to national housing and community needs.

Building on our classification improvements in Q1, the growth of Recreation & Sport in this quarter’s data, now accounting for 9% of organisations, confirms the sector’s momentum and demand for sports leadership talent.

Conversely, the International subsector continues to decline, with just 11 roles recorded, a 42% drop from Q2 2024. This aligns with ongoing reductions in international development funding, including cuts from USAID, with longer-term impact reflected in reduced hiring, programme consolidation, and organisational restructuring.

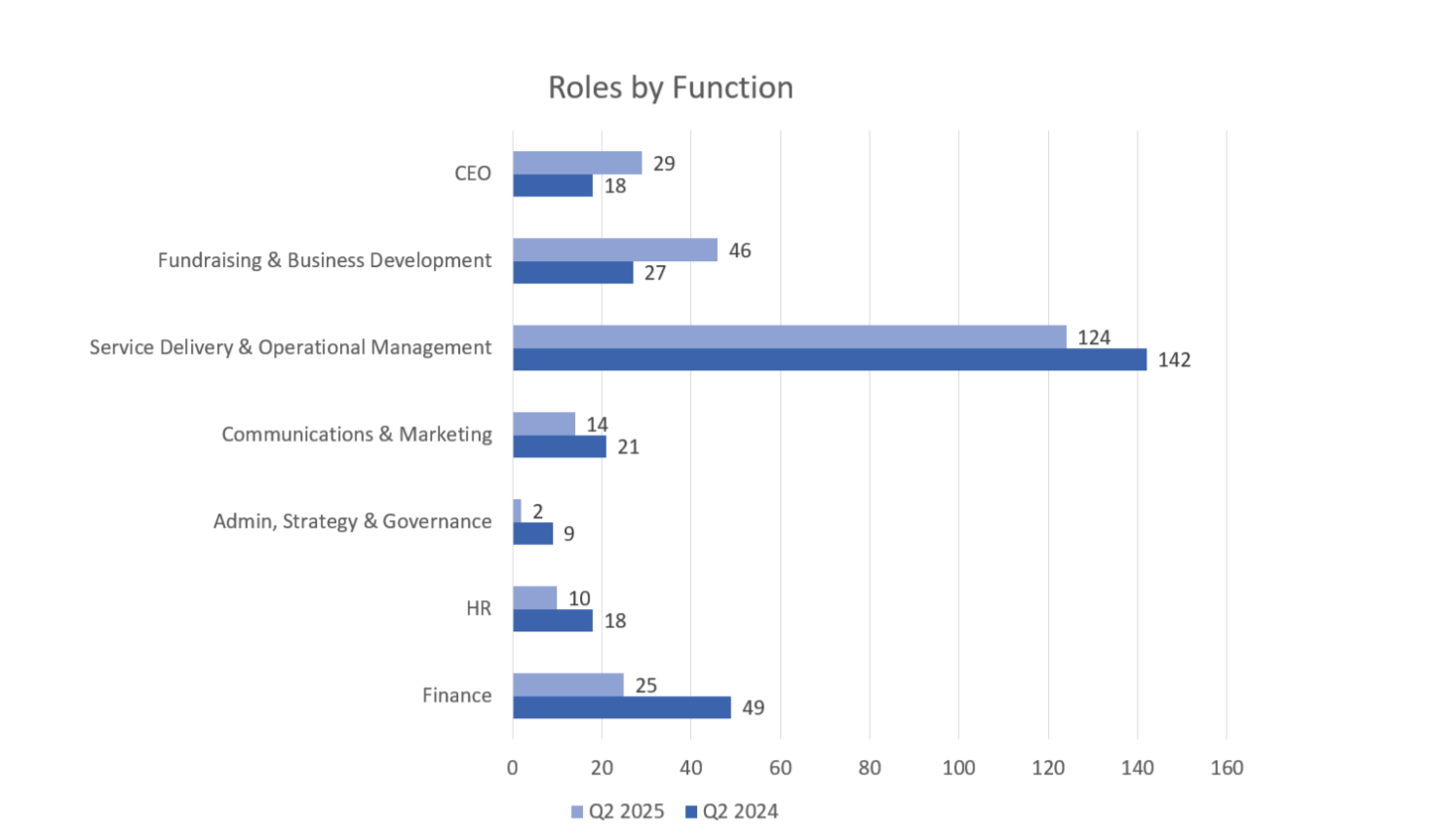

Activity by Role Function

Service Delivery & Operational Management remains the most in-demand function, accounting for 41% of all roles advertised in Q2 2025. While this represents a modest decline from 47% in Q2 2024, it reinforces the continued prioritisation of programme delivery and frontline service leadership across the sector.

A particularly noteworthy shift is the increase in Fundraising & Business Development roles, rising from 10% to 18% of advertised roles, year-on-year. This trend indicates that organisations are placing a renewed focus on income generation, likely in response to funding uncertainty and the need to diversify revenue streams. This rise may also reflect higher turnover within fundraising functions, with fundraisers are navigating an increasingly challenging fundraising landscape in a space where median tenures already tend to be shorter.

The proportion of CEO roles has doubled, moving from 6% in Q2 2024 to 12% this year, suggesting greater movement at the executive level than in previous quarters. This also reflects a need for succession planning and strategic renewal within organisations who rely heavily on long-standing CEOs. This contrasts with trends seen in late 2024, where CEO recruitment was subdued.

Activity by Income Type

Data regarding income was available for 139 of the 186 organisations, as those who advertised anonymously or did not disclose their income (47 organisations) were excluded.

Of the remaining 139:

- 33% (46 organisations) reported annual income exceeding €10 million

- 22% (31 organisations) reported income of less than €1 million

This distribution aligns with patterns observed in previous quarters, highlighting a broad mix of organisation sizes engaging in senior recruitment. While the majority fall within the €1 million to €10 million income range, the data shows that larger organisations continue to dominate leadership hiring, suggesting they may have greater capacity to invest in senior talent acquisition.

Key Observations

Q2 2025 reflects a slight slowdown in nonprofit recruitment activity, with fewer roles and organisations participating compared to the same period last year. However, shifts in functional demand, particularly in leadership and fundraising, point to evolving sector priorities. Growth in areas such as health and sport, alongside reduced activity in international and finance roles, highlights a rebalancing of focus across subsectors.

Overall, while activity has softened, demand for senior talent remains strong and multifaceted, with organisations responding to a changing funding environment, evolving societal needs, and strategic growth ambitions.

Get in Touch

Our Talent Management Team monitors senior hiring across the nonprofit sector and publishes quarterly insights. To explore previous Nonprofit Talent Trends Reports, visit our Talent Insights page. For more information, contact Shannon Barrett, Head of Talent Services, at Shannon.barrett@2into3.com.