Nonprofit Talent Trends – Q3 2023

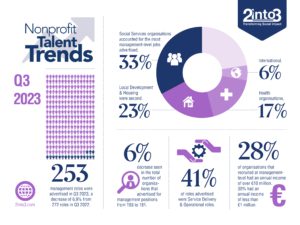

The latest snapshot of senior recruitment activity in the Irish nonprofit sector shows a stabilisation in activity year on year. 2into3’s tracking of roles advertised found there were 253 senior posts advertised in Q3 of 2023, a reduction of 6.9% from the 272 roles advertised in the same period last year.

In terms of the number of organisations that were seeking to fill these roles, the change was similar, at 181 versus 193 in Q3 2022 (down 6.2%). That said, there is an increasing trend appearing in recent months for organisations to advertise roles anonymously, with 31 of the 253 in this review deliberately not identifying the organisation.

Organisational Breakdown

Where information was known about the organisations, the subsector breakdown was as follows:

Two subsectors – Social Services (49) and Local Development & Housing (34) – accounted for 55% of all roles advertised, with the remaining 10 subsectors accounting for the other 45%. Within that group, Health was the largest with 26 roles.

Roles by Subsector

Looking at the number of roles by subsector (again, where we were able to identify this from the advertisements), there were increases and decreases across the subsectors, although with the increase in anonymous advertisements, these figures do come with something of a health warning.

There were increases in the number of roles in the Local Development & Housing and International subsectors, while all others saw a drop in the level of activity, apart from Environment & Recreation & Sport, which were unchanged.

Organisational Income

Where income data was available (for 143 organisations), the usual even split was observed. 40 had income over €10M, 43 had income below €1M and the balance sat between these two.

Role Types

Looking at the types of roles being advertised, 40.7% of those we tracked were in the Service Delivery & Operational Management category, with the next largest area being Finance (18% of all recorded activity) and Fundraising & Business Development (14%). Year-on-year, there were increases in the number of roles in CEO/Executive Director, Finance and Human Resources, with all other role types seeing a decrease or standing still.

Observations

At a macro level, the post-COVID return to stability in the market that we have observed in Q1 and Q2 this year is very much confirmed with a year-on-year of almost identical activity for July – September.

That said, there are some variations to be observed when you break the information we tracked into subsectors and role types. For example, even though the number of Service Delivery & Operational Management roles fell from 145 to 103 between 2022 and 2023, this subsector still accounted for 40.7% of all roles advertised.

The number of Finance roles that were advertised jumped significantly (17 to 46), while the previously active Fundraising & Business Development roles were static, dropping from 39 to 35.

As mentioned above, there seems to be a significant trend emerging with organisations not disclosing their identity when advertising senior positions. From our own perspective, this would appear counterproductive, as nonprofit roles often attract candidates who can identify strongly with their mission, vison, and values. If this is hidden, then you miss that cohort, and may indeed receive enquiries and applications from those who would not be a match for your work.

We continue to track recruitment advertising for the sector and look forward to completing both a Q4 analysis and a full year assessment to share in early 2024.

Contact Us

If your organisation is interested in expanding your team, visit our website for more information, or get in touch with our Director of Talent Management, Fergal O’Sullivan on +353-86-180-6051.