Nonprofit Talent Trends – Q2 2023

The latest snapshot of senior recruitment activity in the Irish nonprofit sector shows a significant slowdown in the number of roles advertised, indicating that the backlog from the pandemic has been cleared.

There was a total of 219 senior roles identified by 2into3’s analysis of the market for Q2 of 2023, down from 270 from the same period last year, a 19% drop. These roles were advertised by 168 nonprofit organisations, down from 186 in 2022, a drop of 10%.

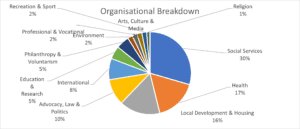

Social Services organisations, at 30%, represented the largest subsector in terms of activity, followed by Health (17%) and Local Development & Housing (16%). The remaining 37% of the roles were between 9 other subsectors.

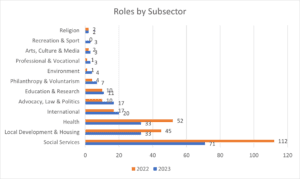

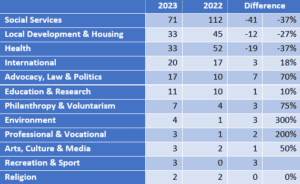

Roles by Subsector

There were some significant shifts recorded in the number of roles advertised in the different subsectors, with Social Services, Local Development & Housing, and Health all showing significant fall-off. Large percentage increases were recorded in a number of areas, but these were mostly coming from a very low base, although International and Advocacy, Law & Politics roles did see a good upward movement.

It is interesting to note the reduction in Local Development & Housing roles, after a sustained period of growth and with such demand for their services. The same could also be said for the Health subsector, although that could possibly be explained as a post-COVID settling down.

Income Breakdown

As is often the case when we gather this data, there was a fairly even split in terms of the size of organisations recruiting senior roles. Where income data was available, 25% of organisations had income of over €10M per annum, while 26% had income below the €1M level.

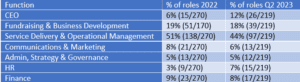

Role Functions

When looking at the types of roles being advertised, there was a certain level of consistency versus Q2 2022 in percentage terms, with a few exceptions.

Summary / Observations

So, what does April, May and June tell us about nonprofit recruitment in 2023? As mentioned above, it does look like pandemic-related activity has finally worked its way through the data and activity is returning to the levels seen before mid-2020.

We are still seeing a lot of the market activity being driven by a small number of subsectors, but this is relatively normal and to be expected. What does look interesting and will be worth tracking in the second half of the year is whether the downward movement for large subsectors such as housing and health is maintained, or if other areas show any significant movement.

For more information on our previous Nonprofit Talent Trends, visit here, or contact our Director of Talent Management, Fergal O’Sullivan.