Nonprofit Talent Trends Q3: Senior Recruitment Reflecting Continued Caution Amid Funding Pressures?

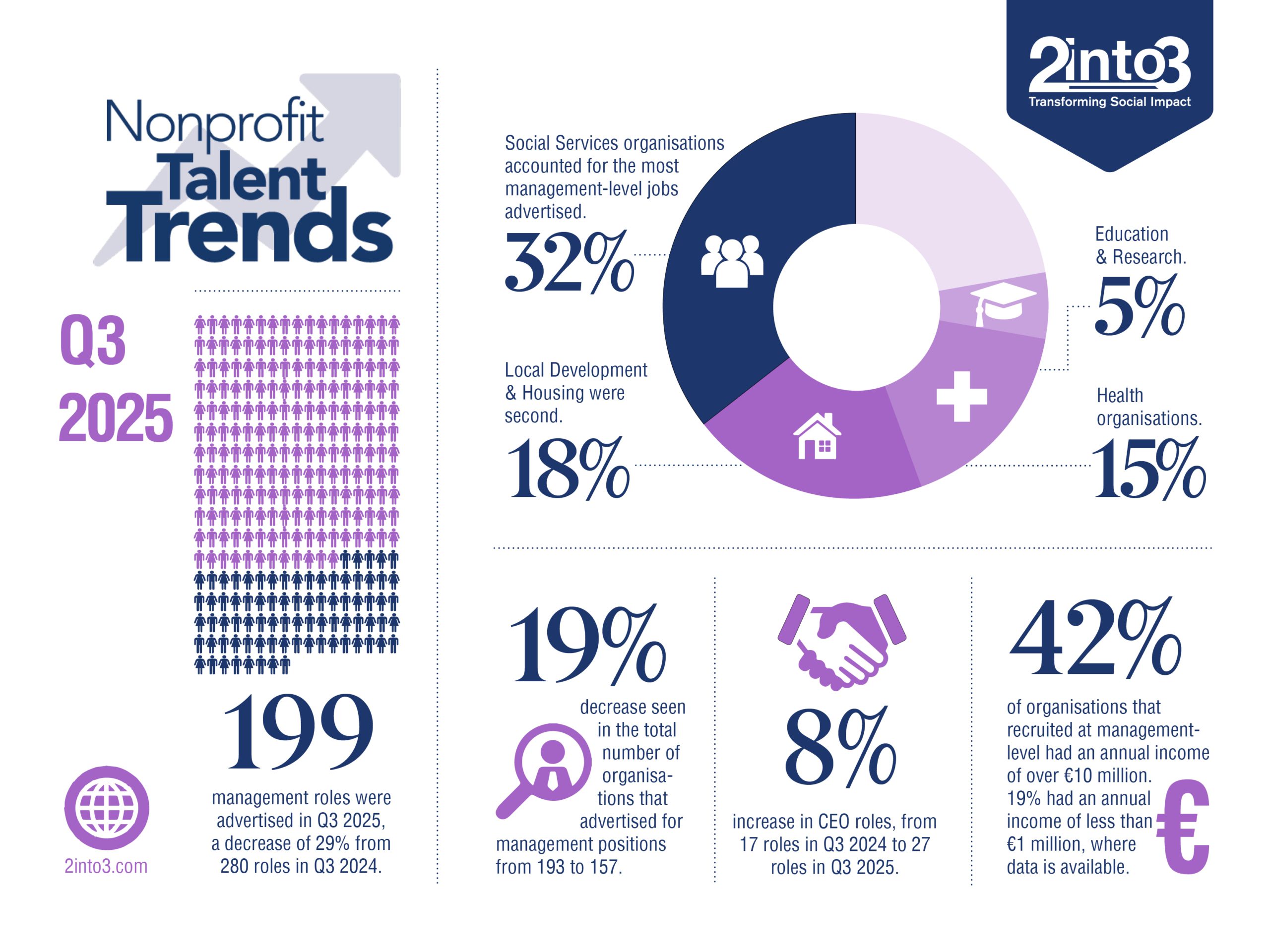

Our latest quarterly analysis of senior-level recruitment in the Irish nonprofit sector points to a marked slowdown compared to the same period last year. Across the main job platforms we track, advertised management-level opportunities declined from 280 roles in Q3 2024 to 199 roles in Q3 2025, a year-on-year decrease of 29%.

The volume of organisations advertising has also decreased, with 157 organisations recruiting in Q3 2025, down 19% from 193 in Q3 2024. This cooling likely reflects continued caution amid funding pressures, resulting in a recalibration of organisational priorities.

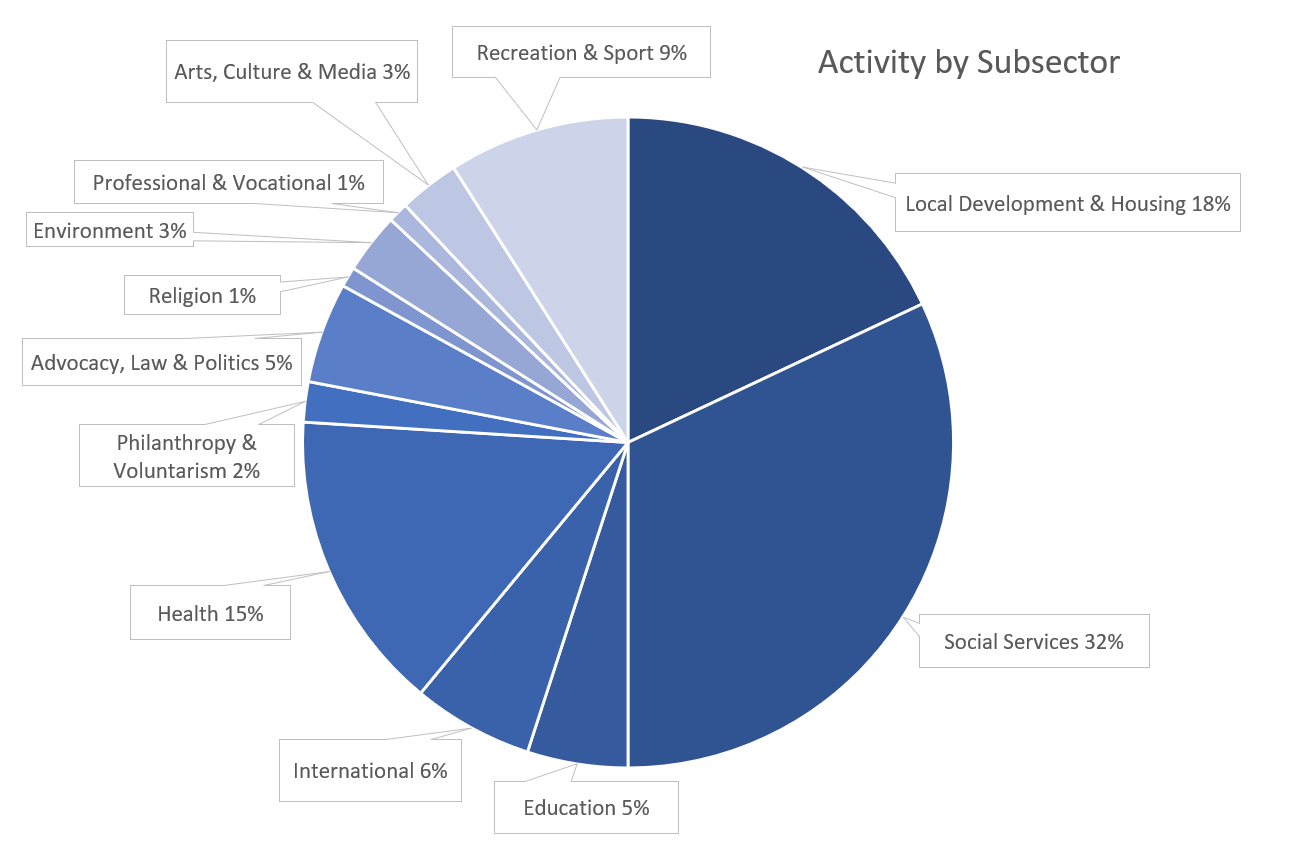

Activity by Subsector

Consistent with previous quarters, several organisations advertised vacancies anonymously. Of the 157 organisations tracked, 15 were not identifiable, resulting in the below breakdown of 142 known organisations by subsector.

Roles by Subsector:

Social Services remains the largest subsector for senior recruitment, representing 32% of known advertising organisations. This underscores the continued priority placed on leadership within frontline service delivery, particularly as organisations address complex social and community challenges.

Health and Local Development & Housing also continue to be key recruitment areas, accounting for 15% and 18% respectively. Despite fewer advertised roles year-on-year, both maintain consistent organisational presence, suggesting sustained structural demand tied to national needs in healthcare, housing and local development.

Recreation & Sport, compromising 9% of identifiable organisations, continues its upward trajectory. Growth in this area reflects the increasing professionalisation of sport leadership and the sector’s broader contribution to wellbeing and community cohesion.

Overall, hiring continues to concentrate within service-oriented areas where demand for experienced leadership remains strongest.

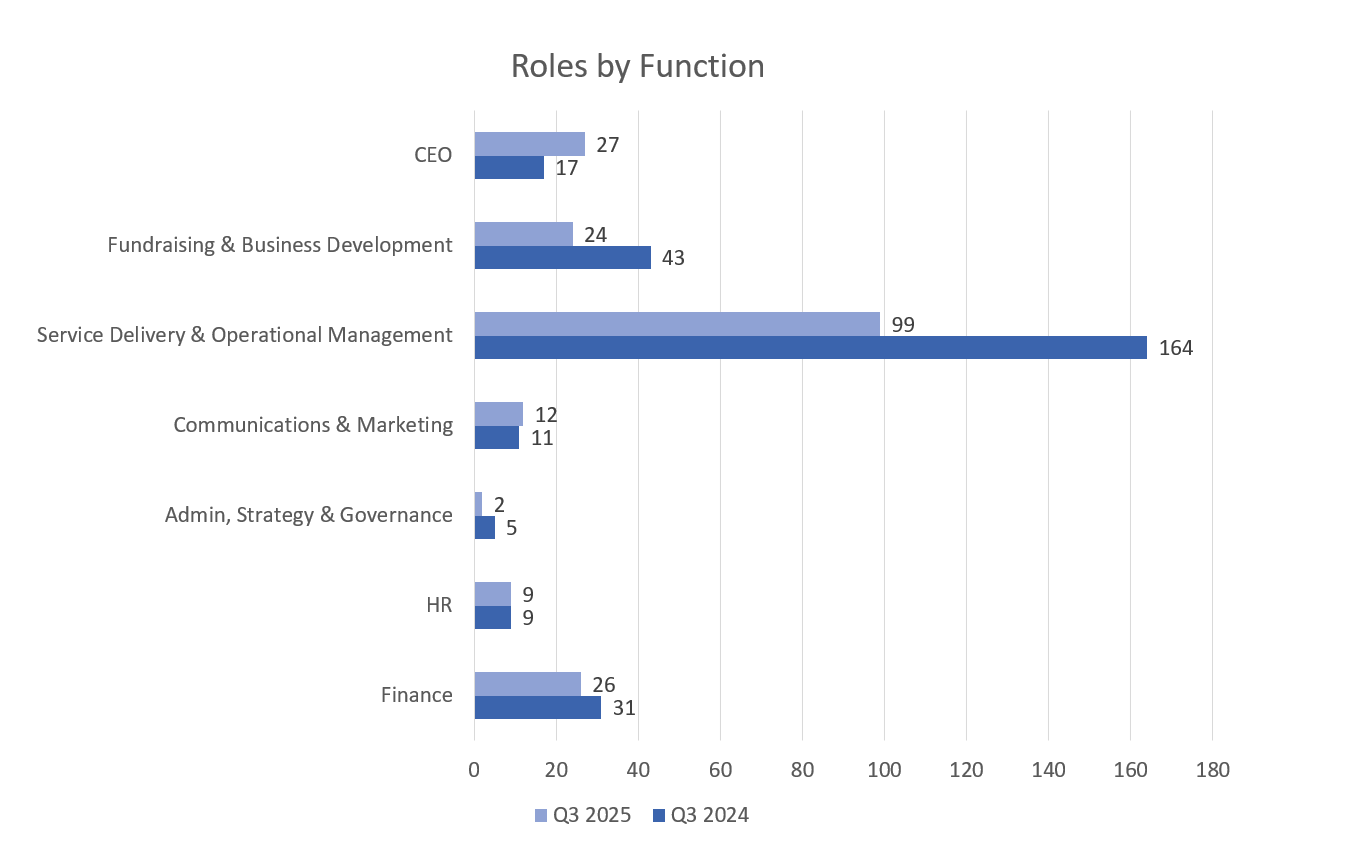

Activity by Role Function

The most notable development in Q3 2025 is the sharp rise in CEO recruitment, which increased from 6% of roles in Q3 2024 to 14% in Q3 2025. It is plausible to hypothesise that this significant wave of executive movement across the sector may be linked to the conclusion of three-to-five-year strategic cycles that organisations introduced following the pandemic. With post-Covid plans coming to an end, this may have initiated leadership renewal and succession planning, marking a period of strategic transition for many nonprofits.

Service Delivery & Operational Management remains the dominant function, accounting for half of all roles advertised, though this is a decrease from 59% last year. The reduction reflects the overall cooling of recruitment activity rather than a drop in demand for operational leadership, as programme delivery continues to be at the heart of non-profit work.

In contrast, Fundraising & Business Development roles declined from 15% to 12%, suggesting a pause after previous growth periods and possibly a consolidation of income generation capacity.

Modest increases in Finance (from 11% to 13%), HR (from 3% to 5%) and Communications & Marketing (from 4% to 6%) highlight a growing focus on internal capability and resilience. Areas such as financial management, people leadership and stakeholder engagement are increasingly viewed as central to organisational stability in a more complex operating environment.

Overall, the data points to a sector rebalancing its leadership structures, with renewed emphasis on executive oversight and strategic direction.

Activity by Income Type

Excluding the 37 organisations that did not disclose income, of the 120 organisations with publicly available income bands:

- 19% (23 organisations) reported annual income less than €1 million

- 46% (55 organisations) reported annual income of between €1 million and €10 million

- 35% (42 organisations) reported annual income more than €10 million

This distribution reflects a familiar trend – mid to large organisations dominate senior-level recruitment, suggesting they retain the capacity to continue investing in leadership talent even as overall activity cools.

Key Observations

Q3 2025 indicates a clear softening in senior recruitment across the nonprofit sector versus last year, with fewer roles and organisations active compared to last year. Larger organisations continue to drive most recruitment activity, reflecting their stronger capacity to sustain leadership investment despite a more uncertain funding environment.

While overall activity has eased, the demand that remains for particular skillsets is more deliberate and strategic in focus. The marked rise in CEO appointments signals a period of strategic transition across the sector, as organisations place greater emphasis on leadership renewal and long-term planning to ensure they are well positioned for the next phase of growth and impact.

Organisations are balancing the need to maintain service delivery with renewed emphasis on governance, financial resilience and leadership capability. This reflects a sector shifting from expansion to consolidation, strengthening its foundations to navigate an increasingly complex and uncertain environment.

Get in Touch

Our Talent Management Team monitors senior hiring across the nonprofit sector and publishes quarterly insights. To explore previous Nonprofit Talent Trends Reports, visit our Talent Insights page. For more information, contact Shannon Barrett, Head of Talent Services, at Shannon.barrett@2into3.com.